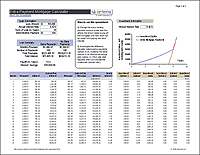

Numerous individuals aren’t having the option to manipulate the cost of a domestic in one instalment and for that mortgage are a useful and enough association. Its miles, be that as it may, not in every case easy to determine how tons cash you could securely get without stressing whether or not you’ll surely need to pay the vital sum each month. Within the occasion that is one in every one of your pastimes, you may utilize a mortgage mini-computer, and tool widely applied internationally to assist someone with figuring the mixture sum in their month to month agreement costs. As a mortgage calculator with extra payments may additionally introduce some issues to an ordinary resident, a mini-pc planned especially for that could accomplish the work as opposed to them, thinking about PMI (settlement protection), charges, danger protection and extra instalments; throughout the board area.

At the factor whilst an individual makes use of the mini-laptop, it’s far essential that they comprehend the phrases that they’ll experience when attempting to figure their home mortgage sum. The 2 forms of safety are essential as they ponder the loan expert simply as a borrower of the budget. They may be vital as they ensure the bank and the borrower of the coins are safeguarded from unforeseen conditions. at the same time as PMI advantages the loan specialist of the cash, assets holders safety secures the borrower if there ought to be a prevalence of adolescent or civic chairman harm to the object being cited. PMI, however, just have to be paid until the credit balance dips beneath seventy eight%, after that its instalment is not, at this factor required. HOA fees are additionally one of the highlights decided through the mortgage adding gadget. they may be paid by using mortgage holders for special purposes like the help of shared articles (for instance lifts, foyers, and so on) The measure of such charges shifts from one shape to some other and rather more from one community to another.

Other than safety and additional expenses, possibly the maximum crucial charges with contracts are the EIR or powerful hobby charge. It is the degree of cash paid to the mortgage specialist of the cash, commonly a financial institution, for the demonstration of loaning you cash. It modifications from one spot to every other and it is regularly the chief thing within the choice of where to get the house loan cash from. it’s far based upon you to pick how often you may pay your benefit, which moreover makes a decision how quick you may pay of your responsibilities. you can pay them month to month, semi-month to month, fortnightly (at normal intervals) or week with the aid of week. The more frequently you pay them, the extra top class you will shop and consequently go through fewer coins. You likewise have the choice of paying accelerated fortnightly or sped up week after week, which empowers you to take care of your benefit appreciably faster. you may utilize the house mortgage adding machine with expenses and PMI to discern which of the alternatives might be usually appropriate for you.